IPO (Initial Public Offering) Support Services

In preparing for an initial public offering (IPO), you need to complete a huge amount of work involving the entire company, such as building an internal controls system, reviewing accounting policies, and preparing documents for the listing application. These works also require a high level of quality supported by extended expertise and experience. In such a stressful situation, if you receive a guidance that is too formal and aiming only for an ideal figure in a by-the-book manner, it is like being asked to do the impossible task.

We understand the current status, actual conditions, and characteristics of your company, and develop a realistic vision of what your company should be prior to the listing examination. We then identify a process to efficiently realize this vision, and review the process flexibly and elastically in accordance with the progress.

Preliminary Investigation and Issue Management

As a member of the GYOSEI Group, we provide you with support in the enormous and complicated preparation work for listing.

Preliminary Investigation (Short Review)

Objectives of the Preliminary Investigation

Scope of Preliminary Investigation

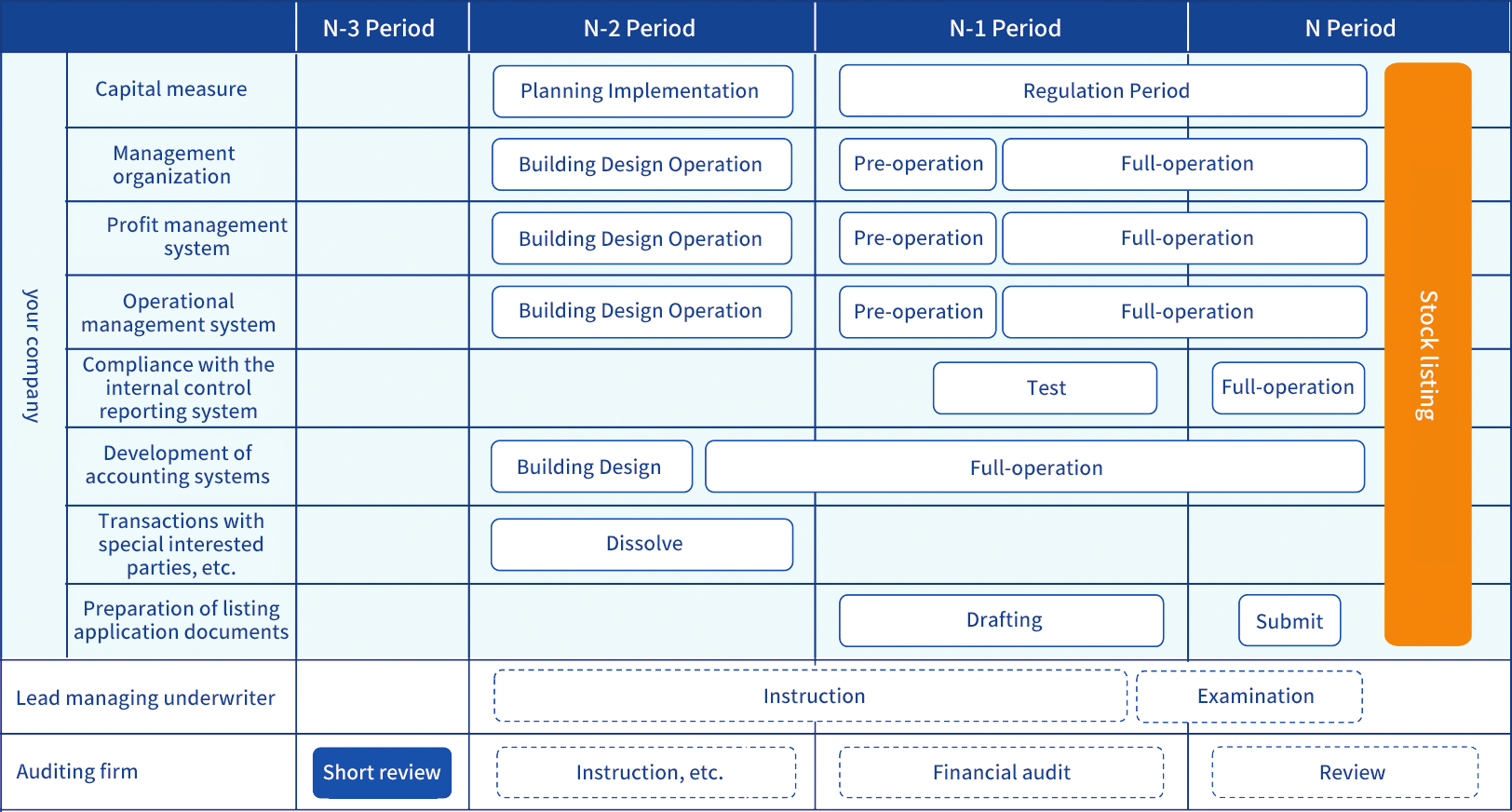

Preliminary Investigation and IPO Schedule

Resolve Issues Identified in Preliminary Investigation

Extended Expertise and Experience to Resolve Issues

Efficient Preparation for IPO

Implement Management Control System

Introduce Internal Rules and Regulations

Scope of Rules and Regulations to be Developed

Rules and Regulations and Listing Examination

Rules and Regulations and Internal Controls

In particular, since the approval system is the basis of internal controls, you need to prepare a ledger of internal memo for approval and ensure its comprehensiveness and continuity.

Introduce Internal Audit

Risk Management and Internal Audit

IPO and Internal Audit

Implement Profit Management Systems

If you have consolidated subsidiaries, you need to develop a system to collect data from the subsidiaries and consolidate their accounts to cope with the PDCA business management cycle on a consolidated basis.

Develop Business Plans / Budget Management Systems / Monthly Closing Systems

Develop Business Plans

Develop Mid-Term Business Plan

Profit Management Cycle (PDCA Cycle)

Revise Mid-term Business Plan (Rolling Method)

Develop Budget Management System

Develop Comprehensive budget

Develop Action Plans

Grasp Actual Results

Implement Monthly Closing

Monthly Closing for Prompt Resolution of Management Issues

Monthly Closing for Timely Disclosures

Monthly Closing and Corporate Management Levels

Implement Corporate Governance

Introduce Internal Controls

In addition, we provide support for the followings, which are important points for listing examination.

Establishment of a system to reject anti-social forces

Related party transactions and liquidation of affiliated companies

Implement Business Management Systems

Implement a Business Management System

J-SOX Compliance

Overall J-SOX Compliance

Efficient J-SOX Compliance

J-SOX Compliance and System Construction

Implement Accounting System

The trouble is, recently, many companies have failed to link sales data with accounting data. It is important to design internal controls prior to implementing an accounting system. In particular, it is highly recommended to utilize API linkage, etc. to avoid information conversion points from internal control points of view.

At GYOSEI CONSULTING, we help you implement not just an accounting system, but also a business management system and an group accounting system.

Implement a Financial Closing System

Shorten Closing Processes

Stock Listing and Shortening Closing Processes

Disincentive to Shorten Closing Processes

Operational Divisions and Disincentive for Closing

Standardize Closing Procedures

Prepare Consolidated Financial Statements

Monthly business performance is to be monitored on a consolidated basis, thus, it is essential to develop procedures for preparing monthly consolidated financial statement at an early stage.

We, GYOSEI CONSULTING, help you to collect information from group companies and to efficiently prepare consolidated financial statements.

Develop Group Accounting Policies

In case there is a Group company whose accounting procedures are based on tax accounting (mainly corporate tax law, etc.), you need to adopt corporate accounting principles and unify the accounting policies.

In addition, in order to assess the performance of group companies based on the same criteria, you need to develop a group accounting policy at an early stage.

We, GYOSEI CONSULTING help you to develop a group company accounting system and group accounting policies.

Revenue Recognition Accounting Standards

Inventory Valuation

Inventories may be valued by the last purchase cost method based on tax accounting, however, companies holding inventories of raw materials, products, goods, etc., i.e., manufacturers, distributors, and so on, are supposed to adopt the perpetual inventory method.

In particular, for proper profit management, inventory control is essential for calculating material costs and is an important element in cost accounting, which may involve system construction.

Therefore, an inventory valuation system including inventory control must be implemented as early as possible.

At GYOSEI Consulting, we help you develop an inventory valuation system based on your inventory management situation and profit management system.

Cost Accounting System

Stock Listing and Cost Accounting System

Cost Accounting and Peripheral Operations

Cost Accounting and Shortening Closing Period

Prepare listing application documents

Prepare Section I and Section II

Other Documentation

Implement Labor Management System

Labor Due Diligence

Improve Working Conditions

Develop HR-related Rules and Regulations

Labor Advisory

to contact us.

We will respond to you as soon as possible.