FINANCIAL ADVISORY SERVICE

We provide the best services in all phases of M&A.

M&A ADVISORY

Comprehensive Financial Research

Financial Due Diligence

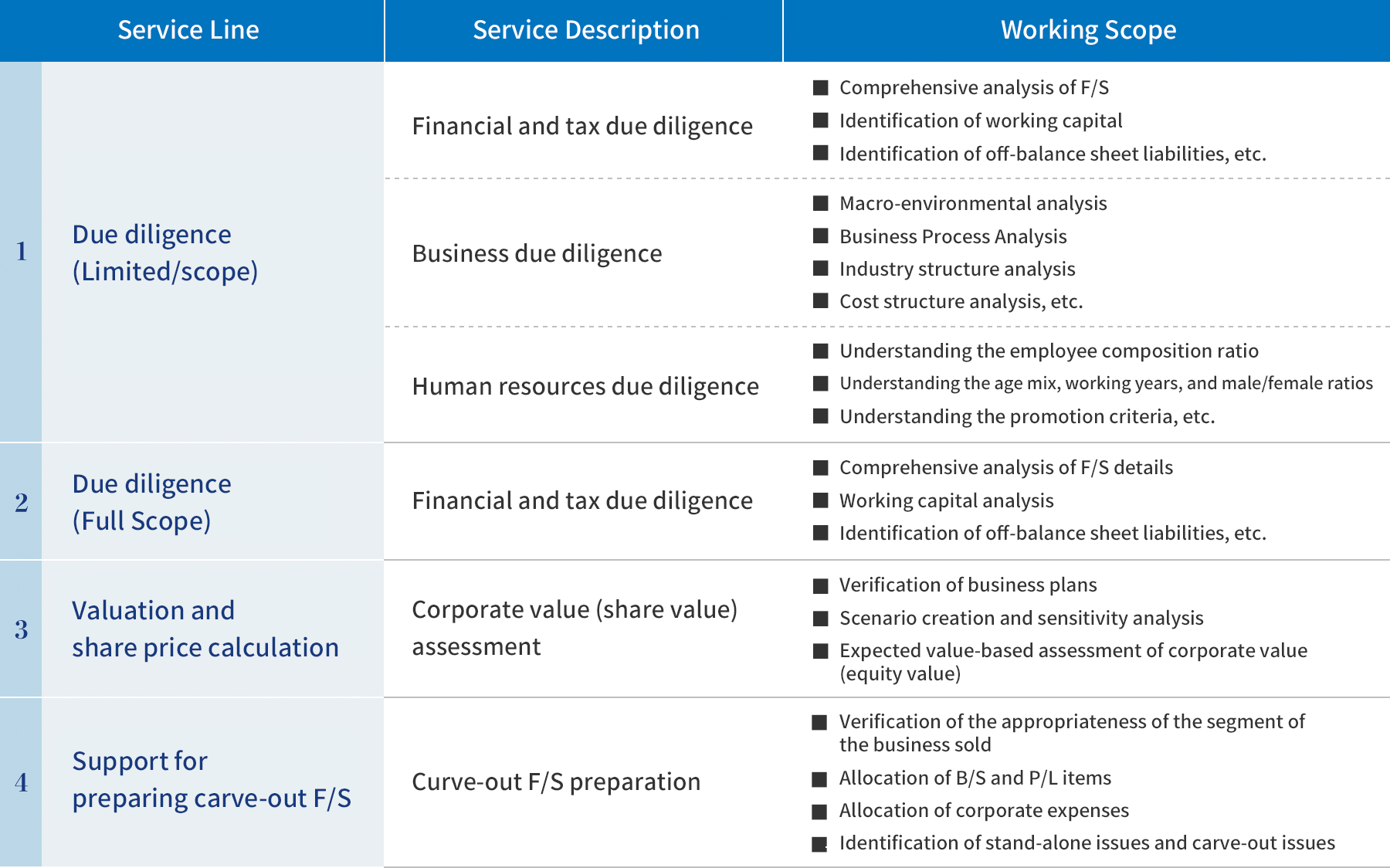

In executing M&A, you need to pay careful attention to the possibility that the target company or business may have a variety of risks.

Specifically, there may be a variety of issues such as: liabilities not on balance sheet, back taxes at the future tax investigation, the possibility of being sued in the future, and so on.

Due diligence is an investigation to ascertain such risks in advance and incorporate them into the M&A decision and the determination of the deal price.

Due diligence is divided into " finance," "tax," "legal," "human resources," "business," and "IT," each of which requires expertise. We collaborate with other professionals to understand the target company or business and to conduct appropriate investigations.

Fair Value Valuation

Valuation

In negotiating the deal price on M&A, you need to assess the appropriate value of the target company or business.

There are various approaches for assessing value, i.e., cost approach, income approach, market approach, etc. It is crucial to choose the best approach depending on the situation of the target company.

We perform various types of valuations, including stock prices, using the best valuation approach that suits the actual situation of the company and the actual conditions of the organizational restructuring transaction.

FA

During the process of a successful M&A, you will be involved in many procedures, i.e., negotiating with counterparties, communicating with various professionals, and preparing contracts and other related documents.

These practical procedures require expertise in accounting, taxation, legal affairs, etc., and at the same time pose many challenges.

By collaborating closely with each professional, we quickly identify and resolve any issues related to the M&A and lead the M&A to a success.

PPA / Impairment test

PPA (Purchase Price Allocation) is the allocation of the acquisition cost to the assets and liabilities of the acquired company after M&A execution.

The PPA process requires not only fair value of assets and liabilities on balance, but also measurement and recording of identifiable intangible assets such as trademarks, licenses, and customer-related assets.

If, as a result of the PPA, the acquisition cost exceeds the net amount of assets and liabilities accepted, the difference is identified as goodwill. The residual goodwill is subject to impairment test, and especially under IFRS, an impairment test must be performed each fiscal year.

The PPA/impairment test is closely related to the valuation at M&A, and requires preparation (e.g., identification of intangible assets to be recognized) prior to the execution of the M&A process.

The results of PPA and impairment test are subject to rigorous auditing by auditing firms, which require a considerable amount of expertise.

We utilize the know-how accumulated at our group's auditing firm to support not only the implementation of PPA and impairment test, but also the response to the auditing firm afterwards.

Structuring

When executing M&A, there are various methods - stock acquisition, merger, business transfer, stock exchange, stock transfer, corporate divestiture, investment in kind, and so on. The costs and legal procedures are different depending on the method used. To minimize these costs, off-balance-sheet liabilities, and tax risks, you need careful consideration of structuring.

We support your optimal structuring not only in accounting and taxation, but also in legal matters in cooperation with legal expertise.

Books

Revised March 31, 2019

Q&A Practice for Corporate Restructuring Mergers, Demergers, Stock Exchanges, etc.

Gyosei & Co. (Author, Editor), Shinsuke Takatani (Supervisor), March 29, 2019

to contact us.

We will respond to you as soon as possible.